How documentation, delays, and overhead on storm damage claims quietly cut into your bottom line.

When the storms roll through and calls start coming in, most roofing companies brace for long days, full crews, and heavy production schedules. What many don’t plan for, however, is the time it takes to handle the insurance side of every job — the phone calls, documentation, follow-ups, supplements, and endless carrier back-and-forth that can drag out for weeks or even months.

For many roofers, the biggest bottleneck in their business isn’t finding work. It’s the slow, inefficient insurance claim process that eats away at profit margins and productivity.

Let’s look at what the numbers really say about the insurance claim timeline, how much documentation work it takes to get a job funded, and what that delay ends up costing your roofing business.

The Timeline Trap: How Long Insurance Claims Really Take

In a perfect world, storm damage claims would move smoothly from inspection to payment in a matter of days. Unfortunately, that’s rarely the case.

- Most roofing insurance claims take 4-12 weeks under ideal conditions — and that’s only when all documentation is correct from the start.

- That means the average roofing claim timeline easily extends to 30–60 days, sometimes longer if supplements or disputes arise.

- Every extra day a claim sits idle is a day your crew, materials, and overhead are burning cash without producing revenue.

The Real-World Workload of Claim Documentation

Filing an insurance claim involves far more than snapping a few pictures and submitting an estimate. Roofers who handle claims internally often underestimate the administrative drag involved in doing it right.

Here’s what the average roofing insurance claim entails:

- 100–150 inspection photos

- Detailed damage notes for each slope, elevation, and structure

- Estimate preparation and revisions

- Communication with homeowners, adjusters, and sometimes engineers

- Follow-up on supplements, code documentation, and line-item clarifications

By the time a single claim is properly documented, the administrative workload can easily total 15–25 hours of office time — and that’s for an uncomplicated residential claim. For commercial or multi-structure losses, documentation and correspondence can double.

When you multiply that by the number of jobs your company handles each month, it’s easy to see how this eats away at production capacity and profitability.

The Hidden Cost of Delays

Every hour spent fighting insurance paperwork is an hour not spent building roofs. Let’s break down the real cost in lost time, sales, and overhead using a realistic example.

Example Scenario:

A roofing company books a storm restoration job estimated at $30,000. Because of slow claim approval and supplement negotiation, the job start date is pushed out by three weeks. During that time:

- Crew Idle Time: A 6-person crew sits partially idle for 15 days, costing roughly $3,000 per day in lost production → $45,000 lost revenue.

- Administrative Overhead: One estimator and one office admin spend 20 hours chasing claim updates at an average rate of $40/hour → $800 additional overhead.

- Opportunity Cost: Two smaller retail jobs ($10,000 each) are delayed or lost because production is booked solid waiting for insurance approval → $20,000 lost opportunity.

Total loss: $65,800 on one delayed claim.

Multiply that across multiple storm-season projects and the numbers become staggering — easily hundreds of thousands of dollars in unrealized revenue each year.

Why Roofers Are at a Disadvantage

The roofing business runs on speed and efficiency. Insurance companies, on the other hand, operate on documentation, verification, and layered review processes. Those two worlds move at completely different paces.

That’s why even experienced contractors often feel like they’re spinning their wheels when dealing with carriers. Every missing line item or unclear photo adds another round of emails or re-inspections. And the more claims you handle, the more administrative overhead you absorb.

Meanwhile, compliance laws make the process even trickier. In most states, roofing contractors are prohibited from negotiating or interpreting insurance coverage unless they hold a public adjuster’s license. That means your team can’t legally push back on carrier pricing, policy interpretation, or payout amounts — even if you know they’re wrong.

In other words, you’re spending time managing claims without the authority to actually manage them.

The Financial Ripple Effect

Delays and administrative overload don’t just slow down one job; they affect your entire business pipeline.

- Cash Flow: You can’t invoice until the claim is approved, which ties up money needed for payroll and materials.

- Customer Satisfaction: Homeowners grow frustrated waiting for updates or partial approvals, which hurts reviews and referrals.

- Crew Morale: Idle time and shifting schedules create uncertainty for your crews and subcontractors.

- Lost Referrals: A slow-moving job in a competitive neighborhood often opens the door for other contractors to swoop in.

Every inefficiency in the claim process compounds over time, costing roofers thousands in both direct and indirect expenses.

How Partnering With a Public Adjuster Changes the Equation

A licensed public adjuster is the homeowner’s authorized representative in the insurance claim process. When roofers partner with one, they eliminate the guesswork and red tape that slow projects down.

Here’s what that partnership looks like in action with Swift Public Adjusters:

- Swift handles the documentation — all inspection photos, damage details, and policy correspondence are prepared and submitted professionally.

- Your company stays compliant — Swift manages negotiations directly with the carrier, ensuring you never risk crossing into unlicensed adjusting.

- You save time and overhead — your team stays focused on production while Swift manages the claim side.

- Claims get resolved faster and more accurately — resulting in fair payouts and smoother builds.

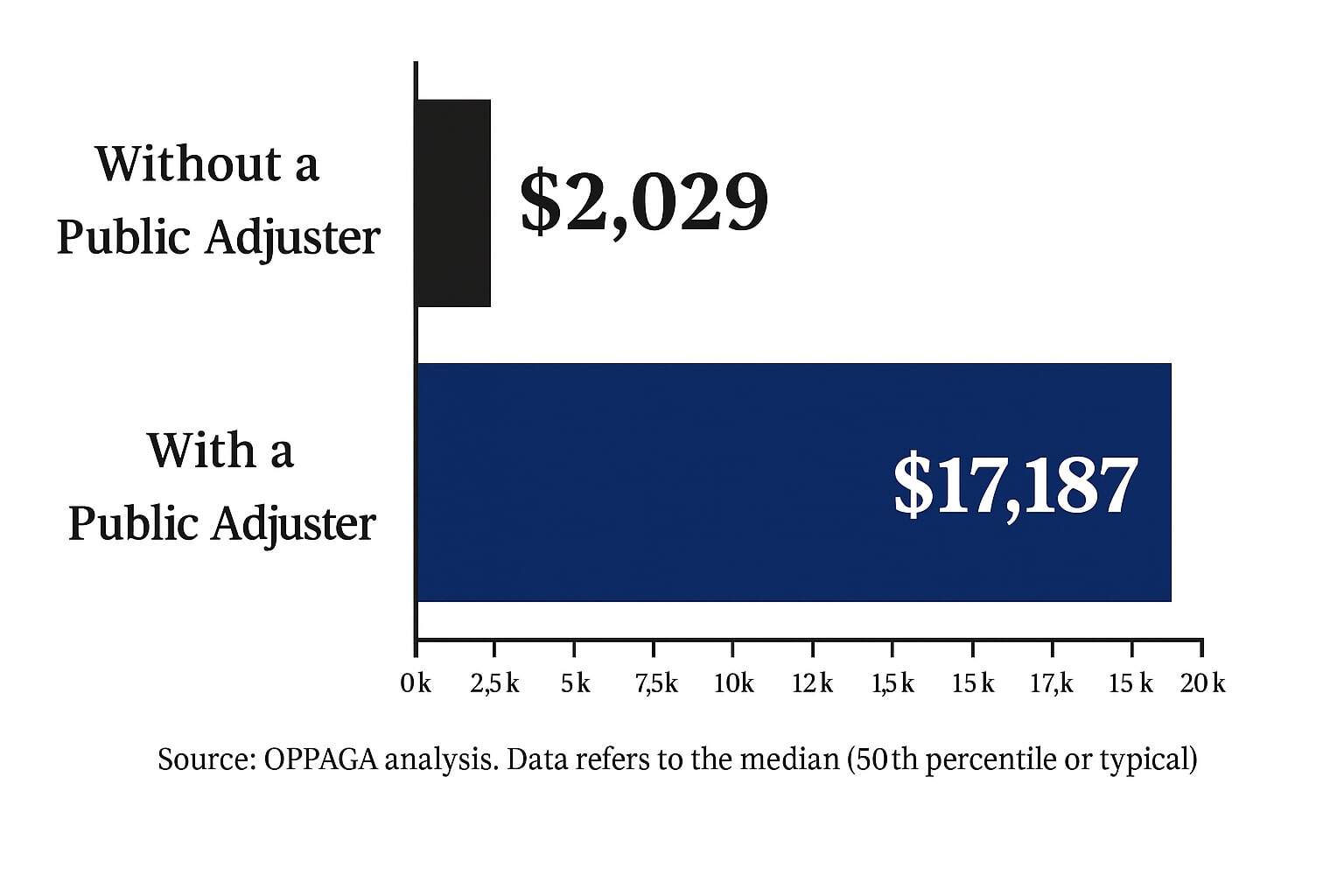

According to the Office of Program Policy Analysis & Government Accountability (OPAGGA), claims handled with a public adjuster result in significantly higher payouts on average compared to those handled without one. That difference can mean the ability to fund full code upgrades, better materials, and improved margins — without your team spending hours on documentation.

A Smarter Way to Do Business

For many contractors, partnering with a public adjuster feels like adding a behind-the-scenes claims department — one that pays for itself many times over.

When the insurance process runs smoothly:

- Jobs start sooner.

- Crews stay busy.

- Homeowners stay happy.

- And your bottom line grows stronger.

Instead of losing weeks of production to slow approvals or incomplete paperwork, you can focus on what drives revenue: roofing, customer relationships, and project quality.

Final Thoughts: Protect Your Time and Profit

The next time a homeowner calls after a storm, consider how much time and money your company really spends managing claims. If the answer is “too much,” it’s time to let an expert handle it.

Partnering with Swift Public Adjusters keeps your company compliant, saves valuable time, and ensures every claim is properly funded from the start. You do the roofing. We’ll handle the claim.

Schedule a short claim review call today online or by calling 866-794-3872.